This article is the latest in a series of articles focused on basic Islamic finance concepts and structures. This article will focus on reverse Murabaha transactions.

What is reverse Murabaha?

Sometimes called commodity Murabaha, or Tawarruq, reverse Murabaha is a variation on the conventional Murabaha structure. It is a form of 'cost plus financing', involving a minimum of four parties.

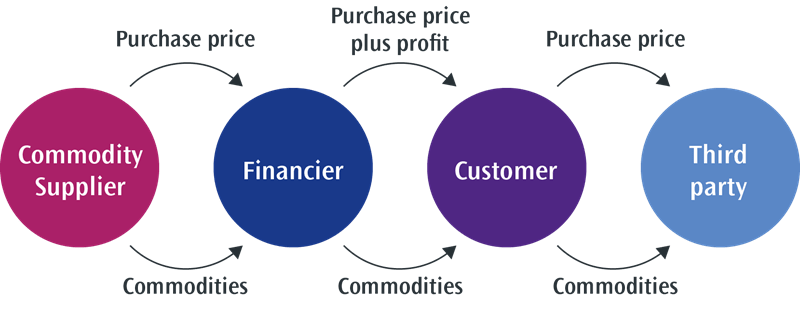

A financier – such as a bank – purchases an asset and offers to sell it to a customer on a grossed-up basis. The sale price of the asset will be fixed between the customer and financier prior to the sale and it will either be payable immediately or on a deferred payment basis. Once the customer receives the asset, they immediately sell it at a spot price, usually to a third party. Unlike a conventional Murabaha, the asset that is used is typically a commodity that is tradable, such as a metal. The end result will leave the customer with a cash amount in return for a payment instalment obligations.

Reverse Murabaha financing involves the actual purchase and sale of a commodity by a financier to generate the economics of conventional debt. It is critical that the financier acquires title to the asset in order to take some commercial risk in relation to it, albeit in practice no physical delivery of the commodity will be taken, which will instead be recorded in commodity ledgers. The profit margin is typically agreed between the parties in advance.

How is it structured?

There are two main stages to a reverse Murabaha transaction and three main contracts.

Firstly, the customer will request a Murabaha from a financier, promising to buy a specified asset, if the financier acquires it. Unlike a conventional Murabaha, a reverse Murabaha will typically use a tradable asset as opposed to an asset that will be utilised by the customer in its business. The financier will then purchase the asset from a supplier (1st contract).

On receipt of the commodity assets, the financier will then immediately sell this to the customer, either on a deferred payment basis with an agreed payment schedule, which is typically the most common form used in the market, or for immediate payment (2nd contract).

Once the title to the commodity assets has passed to the customer, the customer will then immediately sell the commodities to a third party for immediate payment.

The end result will leave the customer with two things: (i) a cash sum, received by virtue of the sale of the commodities to the third party buyer; and (ii) payment obligations to the financier, which will comprise profit payments.

When is reverse Murabaha most often used?

Reverse Murabaha is commonly used in intragroup arrangements and real estate acquisitions. It is flexible because it allows the financier to acquire a commodity asset in lieu of an underlying asset whilst still replicating the cash flows that might be found in a conventional debt arrangement.

As with a traditional Murabaha structure, it may not be well suited for long term financing, or a structure for transactions with payment terms linked to a floating benchmark rate. This is because the profit margin is usually fixed on day one and the financier may lose money if its costs ultimately increase over time.

Security position

How is a reverse Murabaha secured? Security structures tend to be like those found in conventional financing. Like a conventional loan, the customer will grant security over certain of its assets to the financier in order to support the payment liabilities owed to the financier.

For further advice on Islamic finance, please feel free to get in touch.